During our Facebook Live show “Let’s Talk Appraisals”, Sheena, Lissette and I met with James “Jim” Young, owner of Young Residential Appraisals, to discuss what a home appraisal is and why it’s necessary when buying or selling a home.

Jim Young is an independent appraiser and has completed hundreds of appraisals for homeowners in Central Pennsylvania, including Harrisburg, PA.

We sat with Jim to learn all about the appraisal process for buyers and sellers including topics such as:

- What an appraisal is and its purpose when purchasing a home

- Why appraisals are necessary

- Who needs an appraisal

- What appraisers look for when they look at your home

- What happens when the appraisal is lower than the offer

- And much more!

A home appraisal is one of the many things you need as a home buyer prior to closing on your new home, but it’s often one area our home buyers and sellers have questions about as it relates to the overall process.

Read below to learn answers to common questions we hear often about the appraisal process when buying a home.

You can also watch our complete Facebook Live with Jim Young to hear the answers to these questions first-hand.

What is a Home Appraisal and What is its Purpose?

An appraisal is an unbiased professional opinion in regards to how much a home is worth.

“It’s an opinion of value; it’s the appraiser’s opinion of value in the market. There’s a lot of other factors that go into it. But, in simple terms, it’s an opinion of value,” Jim explained.

It’s important to note that an appraisal is one individual’s opinion of the value of the home. Multiple appraisers could evaluate the same property and each appraiser may determine a different value for the same home.

Who Needs A Home Appraisal?

New home buyers and existing homeowners can order an appraisal depending on the situation.

If you’re looking to buy and finance a home using a mortgage, then you need an appraisal prior to your lender finalizing your mortgage loan.

Potential home buyers who pay with cash may choose to waive an appraisal to give them a more competitive advantage in a competing offer situation, although they still may request one.

Existing homeowners who want to refinance their home will also need an appraisal. This is to ensure your mortgage lender is not loaning you more than what the home is worth.

Who Orders and Pays for the Appraisal in a Home Sale?

The buyers will pay for the appraisal in a home sale, which can cost anywhere between $300 – $500 for a single-family home. The appraisal can be paid for up front or added to the closing costs.

As a home buyer, you will not need an appraisal until you make an offer on a home and the sellers accept the offer. Then, once you sign the purchase agreement, and as part of the loan approval process, your lender will order the appraisal, which will be conducted via a third party.

Why Are Home Appraisals Necessary For Mortgage Collateral?

Appraisals are necessary for mortgage collateral because lenders are trying to make sure that the house you are trying to purchase is worth what you are trying to pay for it.

One thing we often discuss when meeting with our potential buyers is what we call the four C’s: Capacity, Capital, Credit, and Collateral.

Appraisals are closely connected to the last C—Collateral.

As Lissette explained during our live, collateral is one thing that is out of your control as a buyer. In the home buying process, collateral is typically associated with the appraisal value of the home you’re interested in purchasing.

The market also plays a role in assessing the home’s value since licensed appraisers will also conduct research on the price other homes in the area have sold for recently.

What Happens if the Home Appraisal is Lower than the Offer?

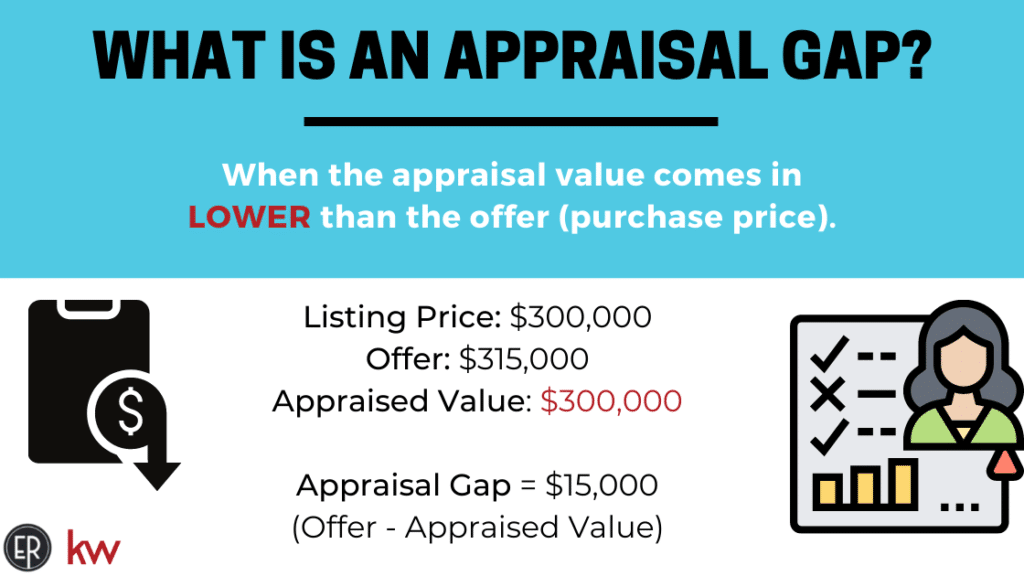

When the appraisal comes in lower than the offer, this is what we refer to as an appraisal gap.

An appraisal gap is the difference between what the appraiser says the value is and the purchase price.

As a potential home buyer, especially in a competitive market where you are likely to have competing offers on a home, your realtor may ask how much you are willing to pay over and above (or below) the actual appraised value. This is another way of asking how comfortable you are with paying more or less than the house is actually worth during it’s appraisal assessment.

What Happens if There’s an Appraisal Gap?

If there’s an appraisal gap between the value of the home you’d like to buy and the agreed upon purchase price, then you have one of two options.

- Work with your realtor to see if you can renegotiate with the seller to drop the purchase price down to the appraised value.

- Secure the extra funds needed to pay the difference between the appraised value and your purchase price.

Here’s an example.

Let’s say you’re interested in purchasing a home listed at $300,000. You offer $315,000 for the house and it’s accepted and you sign the contract. Later on, the lender then conducts an appraisal to confirm whether or not the house is actually worth your offer of $315,000.

The appraisal comes back at $300,000, which is $15,000 below your offer. Because of this, your lender is only willing to finance $300,000 for the home and not the full $315,000 leaving you with a $15,000 difference.

Based on the options listed above you could either:

- Talk with your buyer’s agent about renegotiating with the seller to drop the purchase price to $300,000 – the amount your lender is willing to provide

- Bring $15,000 cash to the closing table to cover the difference; this latter option can often be hard to do on a short notice depending on the set closing date.

It’s important to consider the potential for an appraisal gap since this part of the process occurs after you go under contract by signing the purchasing agreement.

As a buyer, you may want to consider including an appraisal gap clause and/or an appraisal contingency in your contract.

What is an Appraisal Gap Clause/Appraisal Contingency?

During the offer negotiation process, you can include an appraisal gap clause or appraisal contingency in your purchase contract. Both have two different purposes during the home appraisal process.

An appraisal gap clause states that you, as the buyer, are willing to pay the difference between the appraisal value and purchase price.

This may be a good strategy for you during a highly competitive offer where you want to make sure you get the house. It’s a good idea for buyers who have extra cash available to make up the difference, if any, once the appraisal is completed.

An appraisal contingency is a clause that allows you to back out of your contract in the event the appraisal is lower than the agreed upon purchase price.

This is a good strategy if you may not have the extra cash on hand to make up the difference if there is an appraisal gap.

What Does an Appraiser Look for When Valuing a Home?

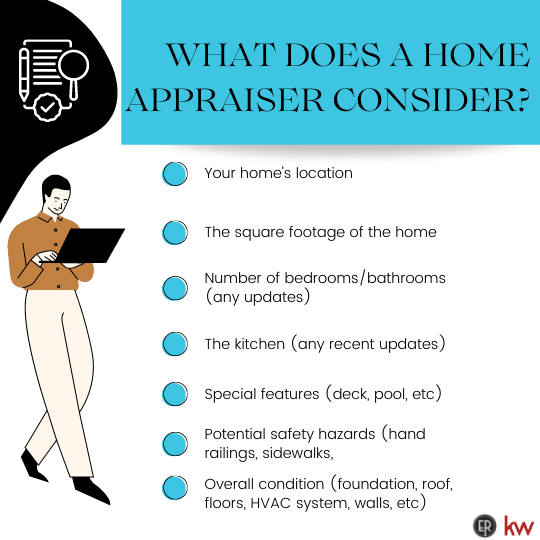

When conducting a home appraisal, the appraiser will look at the home’s location, square footage, number of bedrooms, and number of bathrooms in addition to assessing the overall condition of the home, Jim said.

Additional items the home appraisers will review include, but are not limited to:

- Floors

- Walls (to make sure there are no holes)

- The ceiling – (to check for water stains. If present, they can indicate there could be a sign of past or present roof leakage)

- Foundation cracks

- The kitchen (was it updated?)

- The bathroom (was it updated?)

- The HVAC system (is it working properly?)

- Windows

- Hand railings

- Sidewalk condition

- Safety issues/hazards

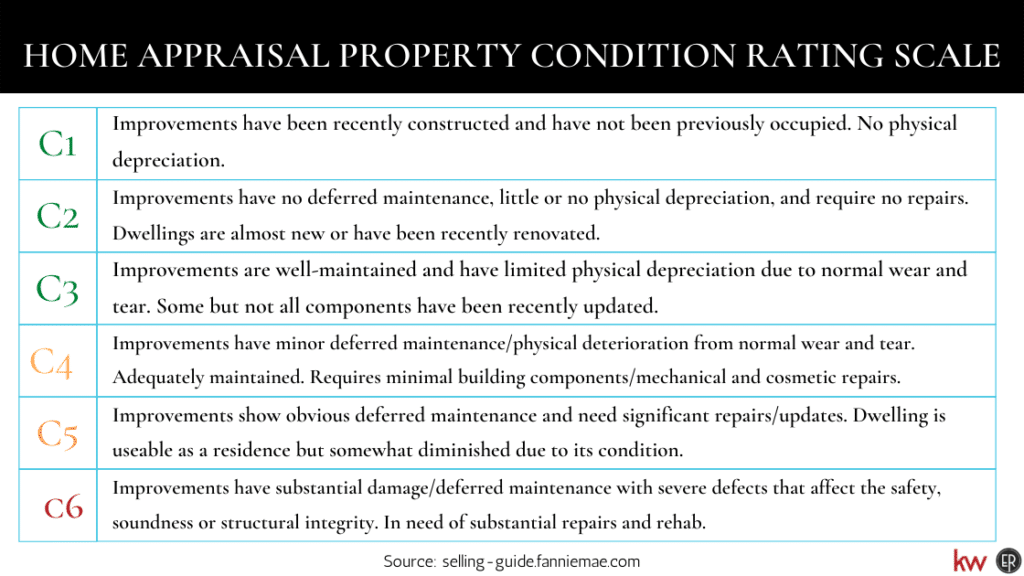

Appraisers will examine numerous aspects of the home and present an overall condition rating in the appraisal on a scale of C1 – C6 — where C stands for condition.

If you receive a C5 or C6 condition rating, it indicates the home is in below average condition. If you have a C6 rating, then that means there is a lot of work that needs to be repaired to the home before a mortgage lender will provide financing for the home.

Do Appraisers Look at Cosmetics?

As real estate agents who work with both buyers and sellers, we often hear people on both sides ask questions like, “what about the granite countertops and hardwood floors?”

According to Jim, individual adjustments don’t happen for cosmetic updates like hardwood flooring or updated countertops. There’s no way for an appraiser to know the square footage of the hardwood floors compared to the square footage of hardwood floors in similar homes in the area.

Cosmetic updates play a small role when looking to compare similar amenities, but they are not a significant part of the overall report.

How Long Do Appraisals Take?

It depends.

If you have a cookie-cutter house that is similar to a lot of recent sales, then it could take a week. If you have a property out in the country and the appraiser has to search for their house, then it could take longer.

As of the market in December 2021, it’s like 2-3 weeks out just to inspect the property.

Do Appraisers Know the Purchase Price?

Yes, appraisers know the final purchase price because they receive a copy of the contract, according to Jim.

However, when pulling comps, Jim said he does it based on the home and not the sale price. By focusing on the condition of the home, its size, size of lot, amenities, etc, Jim said he determines a value that represents what the market says the home is worth.

Even if the purchase price is $30,000 above the list price, the market will tell the appraiser what the home is worth, he explained.

For example, a home is listed at $250,000 and a seller receives an offer for $265,000, which is $15,000 above the asking price. If the home appraisal comes back at $260,000, then the market value of the home is essentially above the listing price.

In seller’s markets, you may have buyers submitting offers above the listing price. If the appraisal comes back at a value that is above the listing price and near the higher offers, then the market value of the home is actually higher than the listed price.