Also Referred to As a Good Faith Deposit

An earnest money deposit, sometimes referred to as a “good faith deposit,” is a deposit a potential buyer submits to a seller prior to officially closing on the property.

The earnest money deposit is meant to show sellers you have a serious interest in purchasing their property and moving forward with the real estate transaction.

You can indicate how large of an earnest money deposit you want to submit when you put in your offer on the home, However, you won’t submit your deposit until after an official agreement of sale has been signed by both parties.

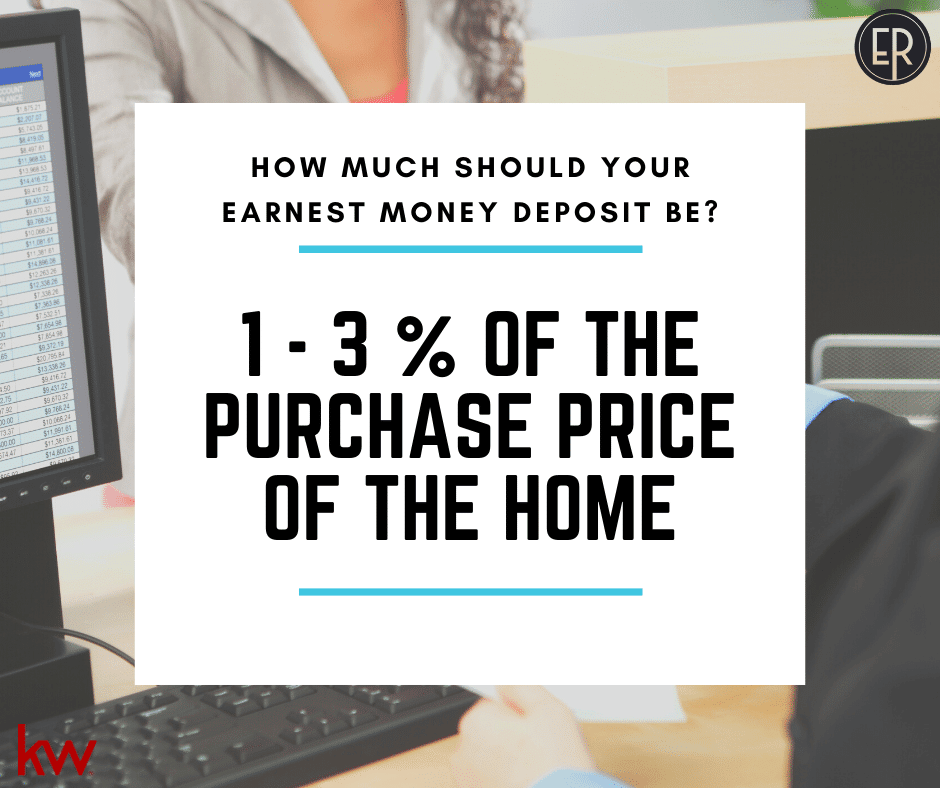

While the amount you submit for your earnest money deposit may vary based on your current real estate market and recent home sales, you can expect to deposit 1% – 3% of the purchase price of the home as your earnest money deposit.

How Many Days Do You Have to Deposit Earnest Money in PA?

In Pennsylvania, you have five days after the seller accepts your offer/agreement of sale to submit your earnest money deposit. However, you do have the option of negotiating that deadline in your contract terms within your sales agreement prior to signing.

Who Normally Holds the Earnest Money Deposit?

You will typically submit your earnest money deposit in the form of a check to your listing agent’s broker, such as Keller Williams of Central PA, or to a title company.

Additionally, the buyer agent’s broker can also hold the earnest money deposit. The earnest money is then kept in an escrow account until the closing process is completed.

Is an Earnest Money Deposit Refundable in Pennsylvania?

Yes and no—It depends on whether you have contingencies outlined in your contract.

An earnest money deposit can be refundable only if certain contingencies have been outlined and previously agreed upon in the original sales agreement between the buyer and seller.

That being said, you should only submit an earnest money deposit on a potential home you truly want to purchase.

If you are submitting offers on several homes, you should carefully consider which homes you’d like to submit an earnest money deposit on and how much that will cost in total.

When Do Home Buyers Get an Earnest Money Deposit Refund?

Most standard real-estate purchase agreements in Pennsylvania contracts include three common contingencies that, if elected, protect your earnest money deposit as the potential buyer so you’re entitled to a refund.

When submitting your original real estate contract to the seller, you’ll typically work with your real estate agent to put an official “offer” on the house.

In your offer, you can choose to include and/or exclude certain conditions, or contingencies, with your offer.

The contingencies you can choose include, but are not limited to, the following:

- Home Inspection or Due Diligence Contingency: The sale is contingent on the results of the home inspection report.

With a contingency in place, you can negotiate for the seller to fix any issues that arise from the report, or terminate the contract and receive a refund for your earnest money deposit. - Appraisal Contingency: The sale is contingent on the house appraising for a value that is equal or higher than the proposed offer.

However, buyers can waive an appraisal contingency if they are willing to pay above and beyond the appraised value of the home since the mortgage lender will only loan the amount the home is appraised for. - Mortgage/Financing Contingency: The sale is contingent on the buyer receiving approval for their mortgage after completing the underwriting process.

What Happens to the Earnest Money Deposit When The Buyer Backs Out?

As the potential buyer, if you back out of the purchase of the home for any reason other than the previously agreed upon contingencies outlined in the purchase agreement, it’s highly possible you will not be entitled to a refund of your earnest money deposit.

The earnest money funds will go to the seller as compensation for the time and effort they spent starting the transaction and not completing it.

This happens because once you enter a contract with the seller for the purchase of a home the seller will take the home off the market.

If the deal falls through after weeks of going through the process, the seller has lost time to sell and possibility of receiving additional offers on the home.

Does Earnest Money Go Toward the Down Payment or Closing Costs?

If everything with the sales transaction goes through with your mortgage underwriting process, then the funds you provided for your earnest money deposit will go toward your closing costs.

However, it’s important to note that your earnest money deposit may not 100% cover all of your closing costs. You may still be required to bring additional funds to the closing table.

Prior to your closing day, your mortgage lender should provide you with a final estimated cost sheet that details exactly how much you’ll need to bring to the closing table, including or excluding your earnest money deposit funds.

If you’re not sure how much you’ll need to bring in cash, or certified check, to the closing table, you’ll want to check with your lender and real estate agent.

Have Questions About Buying a Home? Contact Our Licensed Real Estate Agents

If you’re considering buying a home in Central PA and you have additional questions about your earnest money deposit contact our licensed real estate agents today.

Whether you’re already pre-approved for a mortgage or you’re still in the beginning stages of looking into buying a home, we’ll be happy to meet with you for a free buyer’s consultation.

Contact The Erica Rawls Team at Keller Williams of Central PA today. Learn more about our Harrisburg realtors.

If you’re interested in speaking with a licensed realtor, complete our online form or give us a call at 717-761-4300.