& How to Get Comfortable Talking to Mortgage Lenders

If you’re considering buying a home, you may wonder whether you should get pre-approved for a mortgage before you start looking for one.

While it’s common to look at homes before securing financing, you receive several benefits when you get pre-approved for a mortgage prior to shopping for your new home.

Finances are often one of the biggest hurdles for first-time homebuyers, and the thought of disclosing bank statements, credit scores, tax records and other financial information with mortgage lenders can be intimidating.

As licensed realtors serving Harrisburg and Central PA, The Erica Rawls Team believes our home buyers are placed in the strongest position when they get pre-approved for a mortgage prior to shopping, especially when they know they may expect some issues to arise during the process.

So, to help potential homeowners become more comfortable talking with mortgage lenders about their finances, the Erica Rawls Team sat down with Angie Shaw, branch manager and loan originator at Fidelis Mortgage, to learn:

- Why first-time homebuyers are hesitant to talk to lenders about their finances

- Why so much paperwork is needed when getting a mortgage

- Why mortgage lenders request bank statements & what they look for in them

- Who underwriters are and what happens during the underwriting process

- & much more!

So, Let’s Get Comfortable Getting Uncomfortable With Mortgage Lenders About Finances

As a first-time homebuyer, you may be nervous at the thought of sitting in front of a lender and having your credit score pulled, especially when it can determine your eligibility for something you really want — like a house.

Your credit score is one of the most important factors that will come into play when buying a home.

According to Angie, first-time homebuyers are hesitant to reveal their credit score to mortgage lenders for several reasons, such as:

- They are nervous or insecure about what their credit score looks like

- They are not monitoring their credit score

- They have never pulled their credit score and they have no idea what it is

“Pulling your credit score is the first step to determining what we can do for you, and what kind of programs you qualify for,” Angie said.

There may be programs you qualify for and lenders can find that out upfront. You could think you owe a certain amount for your closing costs, but because a lender has collected your documentation, they might uncover that you qualify for some grant money, she explained.

Even if you attempt to obtain pre-approval for a mortgage and you are denied because of your score, or other factors, you can still obtain a house with a plan in place.

As real estate advisors, we want future home buyers to know you can talk to a lender without making a commitment on a home. You may know you want to buy a home, but you don’t have a plan for getting it, so it’s perfectly fine to talk to a lender before contacting a realtor. When you meet with the lender, you can simply have a conversation to learn what you can get pre-approved for.

If you don’t receive pre-approval at that time, it doesn’t mean it’s a “no” forever. Lenders can put you on a program to help you get to the point where your score is in a good place, Angie explained.

Why Is So Much Paperwork Required to Buy a House?

The amount of paperwork needed to purchase a home may seem daunting to you, but it’s necessary because of fraud.

People across the country — even if it’s only a small minority — try to create fake documents for others or themselves, and the U.S. Department of Housing and Urban Development (HUD), U.S. Department of Veterans Affairs (VA) and conventional underwriters are all under pressure to prove the information home buyers provide in their application is accurate, Angie said.

To cut down on paperwork, some lenders have docless options where you allow them to verify your information electronically by signing into your bank account.

For many, this method may feel like an invasion of privacy, but it’s not. You’re only signing in to authorize the bank to provide the lender with the information they need. You’re not giving out your username or password.

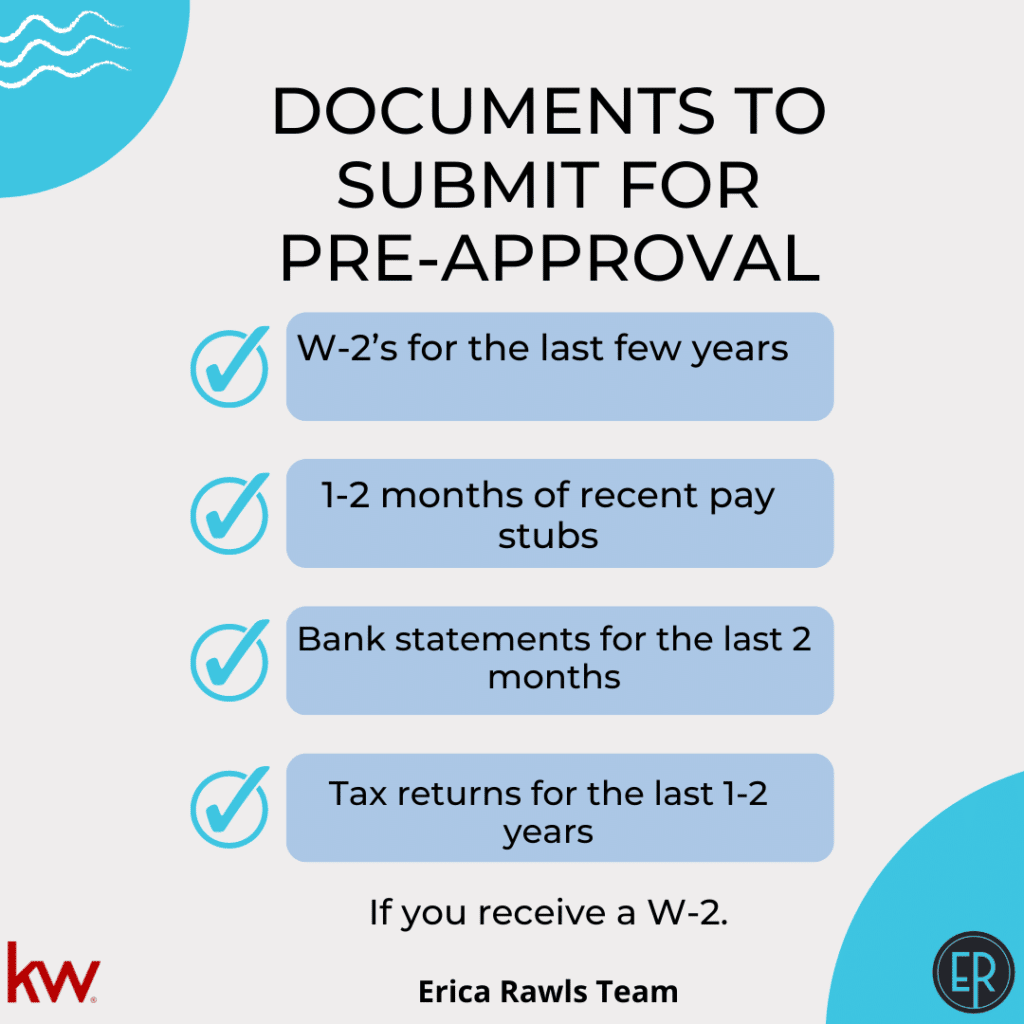

To get pre-approved for a mortgage, if you receive a regular W-2, you can expect to submit the following documents:

- W-2’s for the last few years

- 1-2 months of recent pay stubs

- Bank statements for the last 2 months

- Tax returns for the last 1-2 years

If you pay or receive child support, have a divorce decree, or already own a home, additional documentation will be required.

“The reason why we want that information upfront is so that we can give you the most accurate pre-approval and put you in a program that best suits your lifestyle and your family’s needs,” Angie said.

Consider this analogy.

When you go to your doctor to receive a medical diagnosis, you have to provide your complete medical history, get exams — some that may be uncomfortable, even awkward — and fill out several pages of paperwork. You do all of this so your doctor can provide you with a complete and accurate diagnosis.

As one of our realtors said, “When we know every piece of the puzzle we can definitely advise you in the best way possible. Once you know where you are, you know where you are going,” they said.

“ — and that empowers you,” Angie added.

If you want to go house shopping with the Erica Rawls Team we believe in talking with a lender first because we truly believe in being properly prepared when purchasing a home.

Could you imagine going house shopping and falling in love with a home only to find out you can’t make an offer on it — for whatever reason.

That’s more disappointing than giving up all of your tax and financial information.

One of our responsibilities as realtors is to guide you properly to ensure you have all the tools necessary to make the best investments and decisions — whether it’s the money or the pre-approval you have — so you know everything before making that huge decision.

“Giving that paperwork and documentation upfront can really avoid heartbreak and at pain at the end,” Angie said. “The reason why we ask for a comprehensive list is so that we prepare your life, uncover anything we may not have talked about initially so that you’re not two weeks before settlement and we find out there’s an old tax lien somewhere in another county or state, and it never came up in our search.”

“We’re not judging how much you spend a month, if you go to Starbucks every day, or if you go out to eat every night. We don’t care about that,” she said.

What’s Involved in the Home Mortgage Underwriting Process?

When going into the home mortgage pre-approval process as a first-time homebuyer, you may experience fear of the unknown, particularly when it comes to not understanding what happens in the underwriting process.

You also want to know the personal and financial information you provided ends up in the right hands and remains secure.

We can tell you, as a loan originator, Angie is required to be licensed to take all of your personal information, pull your credit, and determine what program you qualify for in order to structure the mortgage from there. Then, your information is sent to a processor who examines the supporting documents, that were previously reviewed, before submitting them to an underwriter.

The underwriter has designations through HUD, Fannie Mae, Freddie Mac, VA, USDA, or the Federal Housing Administration (FHA) that allows them to underwrite a certain type of loan, like an FHA mortgage loan.

In the home buying process, an underwriter’s role is to audit your documents to determine you have the ability to pay back the mortgage.

Underwriters follow processes to make sure the mortgage meets their underwriting guidelines for their designation, whether it’s for HUD, FHA or conventional. They run programs behind the scenes to check if there’s anything odd out there that wasn’t disclosed — not purposely, but we are going over a lot of information upfront and there are times clients forget about past obligations thinking they have been resolved, Angie explained.

The underwriter is the final decision maker and signs your loan documents — and they are also the ones on the hook if your loan goes bad, too!

So, What Do Underwriters Look for In Your Bank Statements?

According to Angie, when reviewing your bank statements, underwriter’s look for the following potential red flags:

- Large Deposits: If you have a side business and often make large cash deposits, underwriters will ask where the money came from. They want to be sure all funds are sourced and accounted for when using the money to get a mortgage.

- Changing Jobs More Than 3 Times in One Year: If you start a new job every three months that’s considered a red flag because it can make you look inconsistent. This, however, does not apply to freelancers or individuals who are self-employed. If you fall into one of those categories, your income is calculated differently. It’s important for freelancers and entrepreneurs to show they are making money along with two years of their tax returns.

- Inaccurate or Inconsistent Information: Because they are auditing your financings and ability to pay back the mortgage, they need to verify the information submitted in your application is accurate and aligns with your bank statements.

Should You Get Pre-Approval For a Mortgage Before Looking For a House? Yes, It Benefits You!

When you get pre-approved for a mortgage before you start looking for a home, you can look securely knowing that if you write an offer you will go to the closing table.

And, if you’re not approved right away that’s okay! We will work with you to get you there.

“What’s great about Erica’s team is that I’ve been with them where we worked [with clients] for a year. We do not mind putting in the time. If we give you a plan and you’re sticking to it, they will stick with you and they will be there at the end when you finish the plan,” Angie said.

Are You Looking for Real Estate Agent? Contact The Erica Rawls Team Today!

If you’re ready to take the next steps to purchase your new home, complete our online form or give us a call at 717-761-4300 to contact the Erica Rawls Team online today!